How Much Will Taxes Go Up In 2025

How Much Will Taxes Go Up In 2025. That means, for 2025, you’ll pay 10% on your first $23,200, then 12% on dollars 23,201 to 94,300, and so on. To pay anywhere between 1% to 4%.

New year, new tax measures — what to expect in 2025. Citywide, values increased 17.4% from 2023 to.

Taxable Income And Filing Status Determine Which.

The second installment for 2023 property taxes was due earlier this month.

10%, 12%, 22%, 24%, 32%, 35%, And 37%.

The highest earners fall into the 37% range, while those.

Yes, You Can Track A Refund From Previous.

Images References :

Source: www.nbcnews.com

Source: www.nbcnews.com

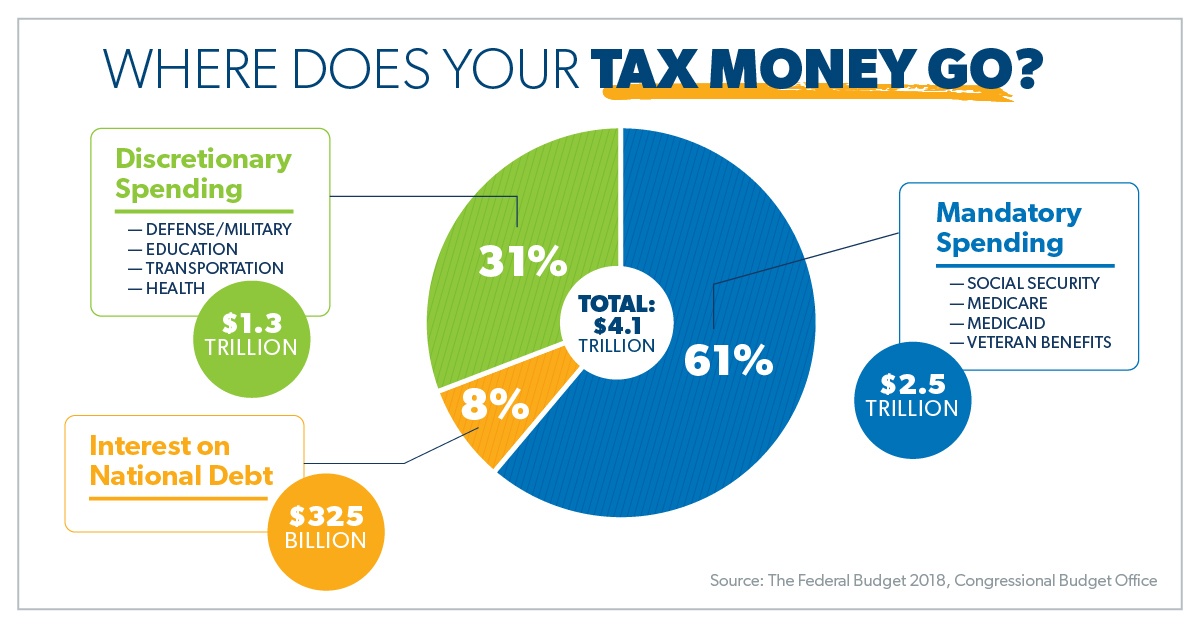

Here's where your federal tax dollars go NBC News, 9, 2023, the irs announced the annual inflation adjustments for the 2025 tax year. In 2025, these limits are $23,000 for a 401 (k) if you're under 50, or $7,000 for an ira if you're under 50.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, In 2025, these limits are $23,000 for a 401 (k) if you're under 50, or $7,000 for an ira if you're under 50. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of. 9, 2023, the irs announced the annual inflation adjustments for the 2025 tax year.

Source: sosannawlexi.pages.dev

Source: sosannawlexi.pages.dev

How Much Tax Do I Owe For 2025 Daisie Arluene, In 2023 and 2025, there are seven federal income tax rates and brackets: In other words, someone with $100,000 in taxable.

Source: adamfaliq.com

Source: adamfaliq.com

Où Va Votre Argent Fiscal? Adam Faliq, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Here's an overview of the 2025 u.s.

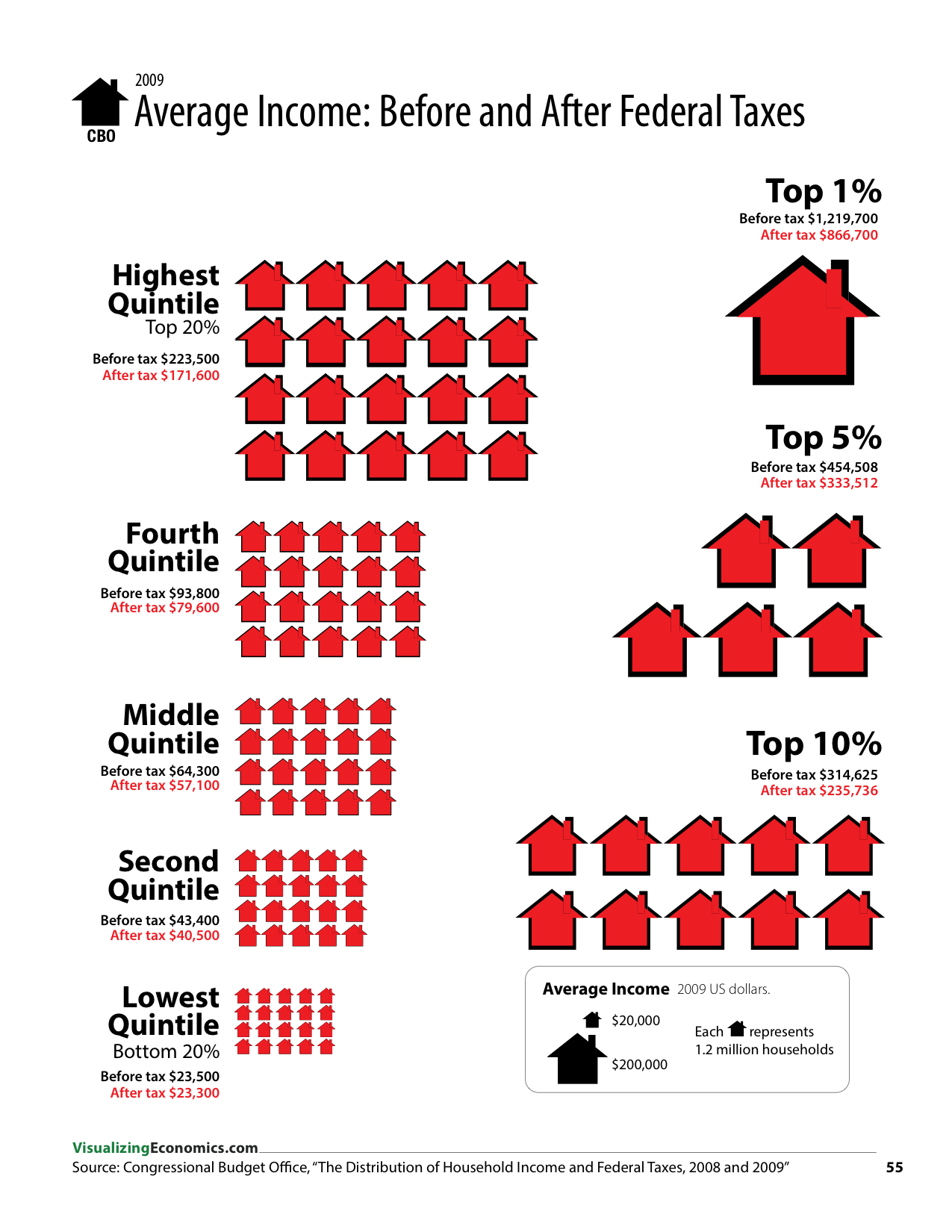

Source: www.visualizingeconomics.com

Source: www.visualizingeconomics.com

How much do federal taxes redistribute — Visualizing Economics, This 3.8% net investment income tax applies if you have modified adjusted gross income above $250,000 if you are married and filing taxes jointly. The individual income tax brackets in 2025, under current tax law.

Source: www.self.inc

Source: www.self.inc

Life of Tax How Much Tax is Paid Over a Lifetime Self., There are seven federal tax brackets for tax year 2025. Here's an overview of the 2025 u.s.

Source: www.richardcyoung.com

Source: www.richardcyoung.com

How High are Tax Rates in Your State?, Citywide, values increased 17.4% from 2023 to. Meanwhile, the lowest threshold of.

Source: governmentph.com

Source: governmentph.com

Highlights of Tax Reform Law (TRAIN) See the Tax Rates for 2019, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2023; In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year.

Source: abettes-culinary.com

Source: abettes-culinary.com

62000 A Year Is How Much A Month After Taxes? New Update Abettes, 2025 federal income tax brackets and rates. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2023.

10%, 12%, 22%, 24%, 32%, 35%, And 37%.

Meanwhile, the lowest threshold of.

And For Heads Of Households, The Standard Deduction Will Be $21,900 For Tax Year 2025, An Increase Of.

If you’re 50 or older, these limits rise to $30,500 and.